Open Enrollment for 2026 is happening now, running November 1st through January 15th. You may be eligible to enroll in health insurance outside of Open Enrollment, or enroll with an earlier effective date, by qualifying for a Special Enrollment Period (SEP).

Qualifying Life Events

In order to qualify for a Special Enrollment Period you must first be experiencing or have experienced a qualifying life event. You typically have 60 days from the date this qualifying life event takes place to enroll in or update your insurance through CoverME.gov.

Common Qualifying Life Events Include:

- Lost or will soon lose comprehensive health coverage

- Becoming a Maine resident

- Recently lost MaineCare (note: you have 90 days for this SEP)

- Adding a dependent (through birth, adoption, or fostering a child)

- Getting married

- Getting divorced or legally separated

These are only some of the reasons you may qualify for a special enrollment period. For a full list of qualifying life events, and important information about when your coverage will take effect, please see our full list of Special Enrollment Period eligibility criteria (PDF).

The Easy Enrollment Tax Referral Program

The Easy Enrollment Tax Referral Program is the "check the box' option on your Maine state tax return form 1040ME to opt-in to receive more information about the health insurance options available to you. When you opt-in, you authorize the Maine Revenue Services to share your name and contact information with CoverME.gov. We will use this information to send you a communication about how to get enrolled.

How it works

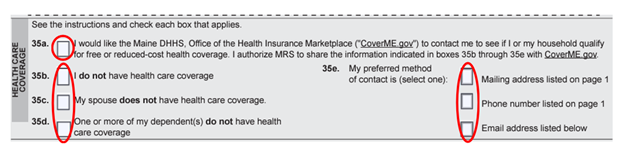

- Check all boxes on form 1040ME that apply to your household. Let us know that you'd like more information about health insurance coverage, who the coverage would be for, and how you prefer to be contacted. By checking the boxes, you give the Maine Revenue Services permission to share your contact information with CoverME.gov. Here's an example:

- File your taxes. After you file your taxes, the Maine Revenue Services will share your contact information with CoverME.gov so we can contact you with more information.

- Watch for the CoverME.gov communication. Once we receive your information, CoverME.gov will contact you by mail, phone or email to explain how to enroll in health coverage. You'll have 35 days to enroll after you contact us to activate your SEP.

- Get enrolled. Call 1-866-636-0355, TTY: 711 or visit CoverME.gov to create an account and start your application using the Special Enrollment Period "Easy Enrollment Tax Referral." If you need help, find a free Broker or Maine Enrollment Assister near you.

Think you may qualify for a Special Enrollment Period?

Follow these steps:

- Create or Log In to your CoverME.gov account

- Report life changes through your CoverME.gov account or by calling our Consumer Assistance Center at 1-866-636-0355 TTY: 711

- Submit Application

- Answer determination questions

- Shop for plans!

For more information, visit our New Customers page.

If you are currently enrolled in a health insurance plan through CoverME.gov you should report changes in income along with any life events immediately.

- If your income decreases or you gain a member of your household, you may qualify for even lower premiums.

- If your income increases or you lose a member of your household, you may qualify for fewer savings. If you don't report these changes, you may have to pay money back when you file your federal tax return.

If you're a member of a federally recognized tribe or an Alaskan Native Claims Settlement Act (ANCSA) Corporation shareholder, you're eligible for enhanced benefits and protections.

- You can enroll anytime during the year, not just during Open Enrollment.

- You're also eligible for lower out-of-pocket costs when you apply for lower monthly premiums.

See our Information for Native Americans page for more details.